Canada’s Department of Finance recently proposed the use of excise stamps for cannabis products following legalization later this year.

Last November, the department published for consultation a proposed excise duty framework for cannabis products. The proposed level of taxation is “intended to keep prices low to eliminate the black market, as discussed at the Finance Ministers Meeting last June,” according to a statement issued by the department. “The proposed duty would apply to all cannabis products available for legal sale, including fresh and dried cannabis, cannabis oils, and seeds and seedlings for home cultivation.”

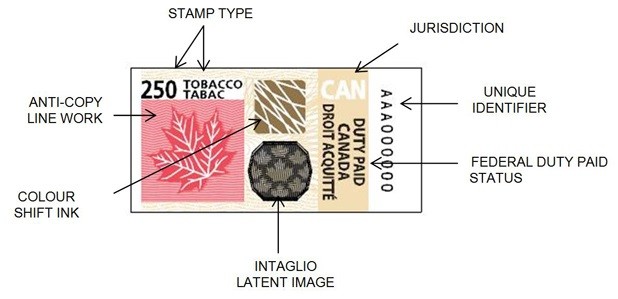

According to the proposal, all cannabis products that will be removed from the premises of a federal licensee to enter into the Canadian market would be required to be packaged in a container intended for sale at the retail level and be required to have an excise stamp.

“As with the current tobacco stamping program, a stamp will need to be affixed to a product:

- In a conspicuous place on the package;

- In a manner that seals the package (i.e., once the package is opened the stamp cannot be in a condition to be re-used);

- In a manner that the stamp remains affixed to the package after the package is opened; and

- In a manner that does not obstruct any information that is required under an Act of Parliament to appear on the package, including Health Canada warnings.”

ADMINISTERED BY CRA

The issuance of stamps will be administered by the Canada Revenue Agency while the stamps will be sold through an authorized provider.

“With respect to stamping within a coordinated taxation framework between federal, provincial, and territorial governments with potentially different duty rates:

- A cannabis licensee (i.e., the manufacturer who packages a product for final retail sale) would have to apply an excise stamp with an indicator (e.g., colour) of the intended provincial or territorial market.

- Diversion of products intended for consumption in a particular province would be subject to penalties.”

The act will also prohibit the possession or sale of any unstamped cannabis products by a person unless otherwise allowed under circumstances prescribed by regulations.

“These allowances would include allowances for persons licensed or registered with the CRA and may further include allowances for:

- A person who is transporting the product under circumstances and conditions prescribed by regulations;

- An individual or person who has imported the product under special permit (see section 12: Imports and Exports below), not for final sale to consumers; or

- An individual who has cultivated cannabis and/or manufactured a cannabis product in accordance with personal-use/cultivation limits as provided under the Cannabis Act.”

Bill C-45—the so-called “Cannabis Act—is now undergoing its second reading before the Canadian Senate. The legislation can be viewed at the Parliament of Canada’s LEGISinfo website.

Late last year, during an interview with Québec’s TVA network, Prime Minister Justin Trudeau said cannabis will be fully legalized nationwide by “next summer” and not on July 1.