Canada Post is exploring postal banking in co-operation with the Canadian Postmasters and Assistants Association (CPAA), a union of rural postal workers.

Under this agreement, Canada Post will invest $500,000 into “the study of how rural post offices could provide banking services such as money transfers or cashing government cheques,” according to an article in the Summer 2020 edition of Union Postale, the quarterly magazine of the Universal Postal Union.

“Thousands of rural towns and villages, and some Indigenous communities, don’t have a bank – but many of them have a post office that could provide financial services. As well, nearly two million Canadians desperately need an alternative to payday lenders,” reads the postalbanking.ca website managed by the Canadian Union of Postal Workers (CUPW), which is separate from the CPAA and represents the majority of Canada Post’s employees.

Hundreds of municipalities and groups have either passed resolutions or sent letters of support to the CUPW.

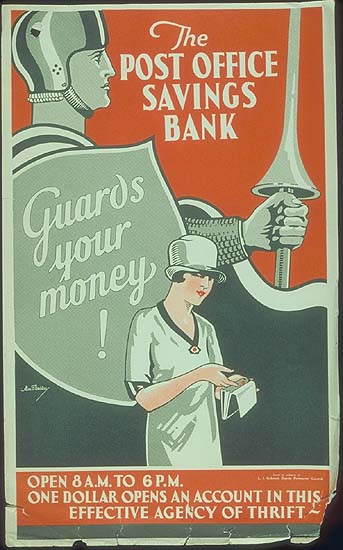

Previously, Canada’s Post Office Department (a predecessor to today’s Canada Post) operated the Post Office Savings Bank, which was created by the April 1868 Post Office Act before being phased out a century later.